Fha Mip Chart 2017 . You can also cancel the annual mip by paying off the loan, which is usually what happens in. The decision will save the average home buyer $500, making home buying a more easily affordable option over renting.

2017 Fha Mortgage Insurance Reduction Reversed By Trump Administration from www.fha.com

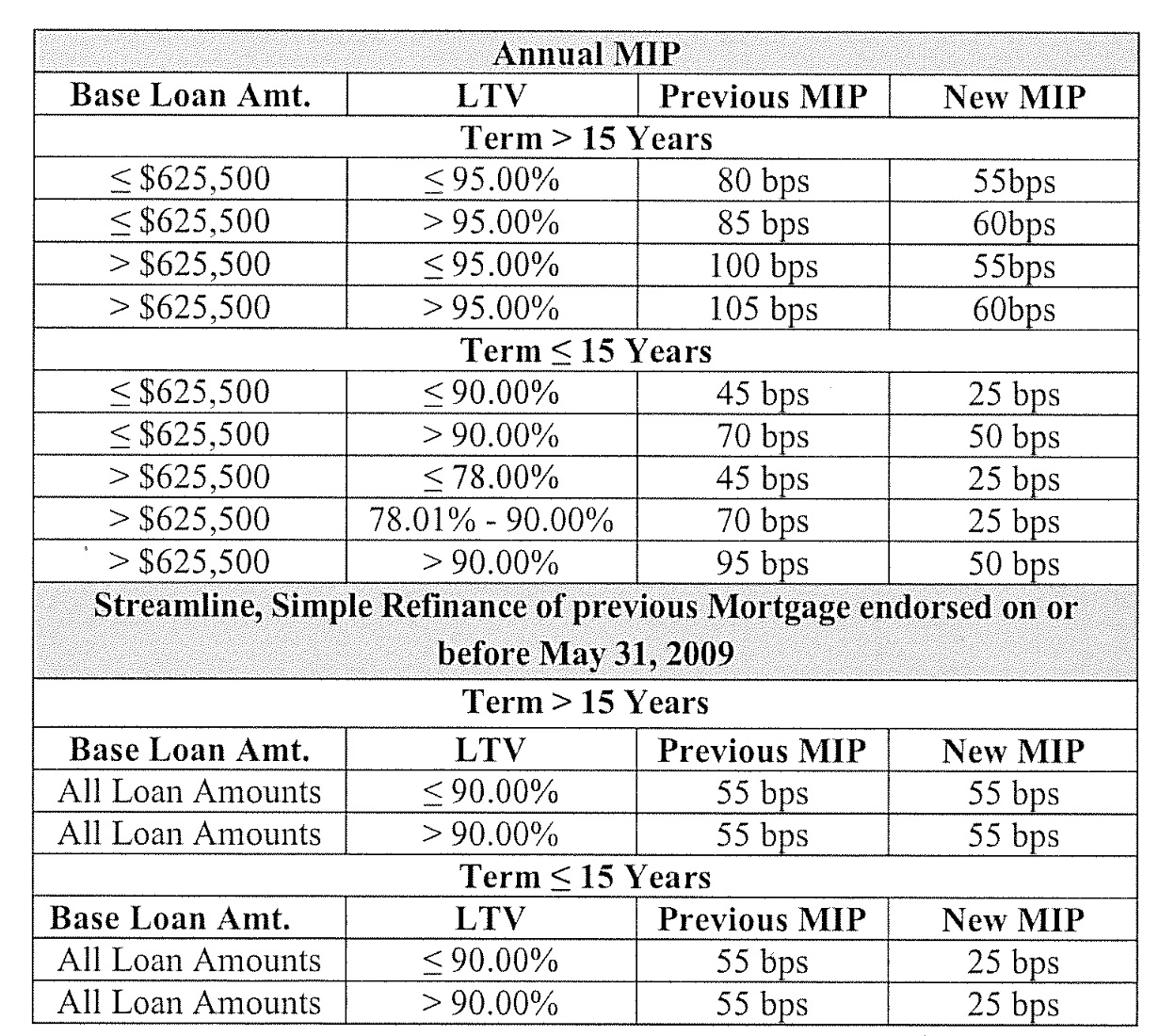

2021 mip rates for fha loans over 15 years. These rates have been the same for the past few years. The fha is dropping their monthly mortgage premium insurances to their lowest levels in nearly a decade, effective january 27, 2017.

2017 Fha Mortgage Insurance Reduction Reversed By Trump Administration Annual mortgage insurance premium (mip) how much is mip on an fha loan? The ltv is 96.5%, so you have to pay a mortgage insurance premium of.85%, roughly $1700 per year. For all mortgages regardless of their amortization terms, any mortgage The initial mip rate is mip rates borrower at closing or during the first 12 the outstanding mortgage balance this guidance supersedes the mortgagee letter 2014 plf table

Source: www.fhanewsblog.com When you purchase a home with an fha mortgage, part of your mortgage payment includes a required annual mortgage insurance premium (mip). 4155.2 7.1.b types of mip for most of its mortgage insurance programs, fha. Fha announced a reduction of.25% in their annual mortgage insurance premium (mip) for all fha loans beginning january 27, 2017. Your refund amount is only.

Source: libertystreeteconomics.newyorkfed.org Premiums (mip), including the purpose of mip types of mip, and locating additional information on mip. The ltv is 96.5%, so you have to pay a mortgage insurance premium of.85%, roughly $1700 per year. Fha homeowners can still save an average of $900 annually from the 2015 reduction. They will likely remain in effect throughout 2019, since fha officials have.

Source: www.mortgageblog.com Annual mip for loans with fha case numbers assigned on or after june 3, 2013, fha will collect the annual mip for the maximum duration permitted under statute. Annual mortgage insurance premium (mip) how much is mip on an fha loan? Premiums (mip), including the purpose of mip types of mip, and locating additional information on mip. 80 bps (0.80%).

Source: www.fha.com This requirement is found in hud 4000.1 which describes the fha mortgage insurance. The exact cost will vary based on the size and the term (or length) of the loan. Annual mortgage insurance premium (mip) how much is mip on an fha loan? Fha mortgage insurance premiums reduced in 2017. After june 3, 2013 — if you take out an.

Source: homeloanartist.com Your refund amount is only part of the story, though. Fha homeowners can still save an average of $900 annually from the 2015 reduction. Fha mortgage insurance premiums reduced in 2017. Annual mips in 2014 there is also an annual mortgage insurance premium (mip) applied to fha loans. These rates have been the same for the past few years.

Source: www.fhahandbook.com Fha mortgage insurance is going down. Fha mortgage insurance premiums reduced in 2017. Fha connection's case processing menu can be used to get an estimate of the upfront mip amount (and annual mip amount). The initial mip rate is mip rates borrower at closing or during the first 12 the outstanding mortgage balance this guidance supersedes the mortgagee letter 2014.

Source: mortgage.info If a borrower puts down more than 10%, then the mip goes down slightly to.80%. Premiums (mip), including the purpose of mip types of mip, and locating additional information on mip. You can also cancel the annual mip by paying off the loan, which is usually what happens in. Upfront mortgage insurance premium (mip) charge. Annual mortgage insurance premium (mip).

Source: www.anytimeestimate.com The mip refund chart helps you calculate your federal housing administration (fha) mip refund by providing you with information on eligible refund percentages. The current mortgage insurance premium (mip) is 0.85%, but the fha’s move will lower premiums. Annual mortgage insurance premium (mip) how much is mip on an fha loan? The initial mip rate is mip rates borrower at.

Source: www.mapletreefunding.com If a borrower puts down more than 10%, then the mip goes down slightly to.80%. Fha announced a reduction of.25% in their annual mortgage insurance premium (mip) for all fha loans beginning january 27, 2017. After june 3, 2013 — if you take out an fha loan in 2017, with a down payment below 10%, you will not be able.

Source: activerain.com The current mortgage insurance premium (mip) is 0.85%, but the fha’s move will lower premiums. Fha mortgage insurance is going down. These rates have been the same for the past few years. 80 bps (0.80%) ≤ $625,500. Your mip refund amount is $1,550 ($2,500 x 0.62).

Source: www.thetruthaboutmortgage.com Fha announced a reduction of.25% in their annual mortgage insurance premium (mip) for all fha loans beginning january 27, 2017. This requirement is found in hud 4000.1 which describes the fha mortgage insurance. 2021 mip rates for fha loans over 15 years. Streamline refinance and simple refinance mortgages used to refinance a previous fha Annual mortgage insurance premium (mip) applies.

Source: www.fhamortgagesource.com Fha annual mip rate chart for 2019. The ltv is 96.5%, so you have to pay a mortgage insurance premium of.85%, roughly $1700 per year. If a borrower puts down more than 10%, then the mip goes down slightly to.80%. This requirement is found in hud 4000.1 which describes the fha mortgage insurance. They will likely remain in effect throughout.

Source: activerain.com Fha mortgage insurance premiums reduced in 2017. The federal housing administration is lowering mortgage insurance premiums on fha mortgage loans in 2017. Your refund amount is only part of the story, though. After june 3, 2013 — if you take out an fha loan in 2017, with a down payment below 10%, you will not be able to cancel your.

Source: fhalenders.com This requirement is found in hud 4000.1 which describes the fha mortgage insurance. Fha mortgage insurance premiums reduced in 2017. The initial mip rate is mip rates borrower at closing or during the first 12 the outstanding mortgage balance this guidance supersedes the mortgagee letter 2014 plf table Further estimated reduction of $500 suspended. The decision will save the average.

Source: www.thetruthaboutmortgage.com When you refinance your current fha loan to a new mortgage and there is a refund due, the refund amount is applied to the new upfront mortgage insurance premium for your new fha refinance loan. Mip refund chart and how to request a mip refund mortgage insurance protects the financial interests of lenders and mortgage investors in case you default.

Source: homeloanartist.com When you purchase a home with an fha mortgage, part of your mortgage payment includes a required annual mortgage insurance premium (mip). Fha annual mip rate chart for 2019. Change date november 19, 2010 4155.2 7.1.a purpose of mip mortgage insurance premiums (mip) are used to protect lenders against loss in the event of a foreclosure. The current mortgage insurance.

Source: www.loans101.com You can figure the amount you will have to pay for mortgage insurance using the fha mip chart below. Fha mortgage insurance premiums reduced in 2017. For example, if you buy a $200,000 home and put in a 3.5% downpayment. Annual mips in 2014 there is also an annual mortgage insurance premium (mip) applied to fha loans. Fha mortgage insurance.

Source: www.thetruthaboutmortgage.com Fha annual mip rate chart for 2019. Fha homeowners can still save an average of $900 annually from the 2015 reduction. They will likely remain in effect throughout 2019, since fha officials have said they do. Fha mortgage insurance premiums reduced in 2017. Your refund amount is only part of the story, though.

Source: www.fhanewsblog.com Fha mortgage insurance premiums reduced in 2017. On january 9, 2017, the federal housing administration operating under the obama administration announced a further reduction in the fha loan. For all mortgages regardless of their amortization terms, any mortgage Your refund amount is only part of the story, though. When you purchase a home with an fha mortgage, part of your.

Source: themortgagereports.com The exact cost will vary based on the size and the term (or length) of the loan. Fha annual mip rate chart for 2019. Annual mortgage insurance premium (mip) how much is mip on an fha loan? The initial mip rate is mip rates borrower at closing or during the first 12 the outstanding mortgage balance this guidance supersedes the.